kentucky property tax calculator

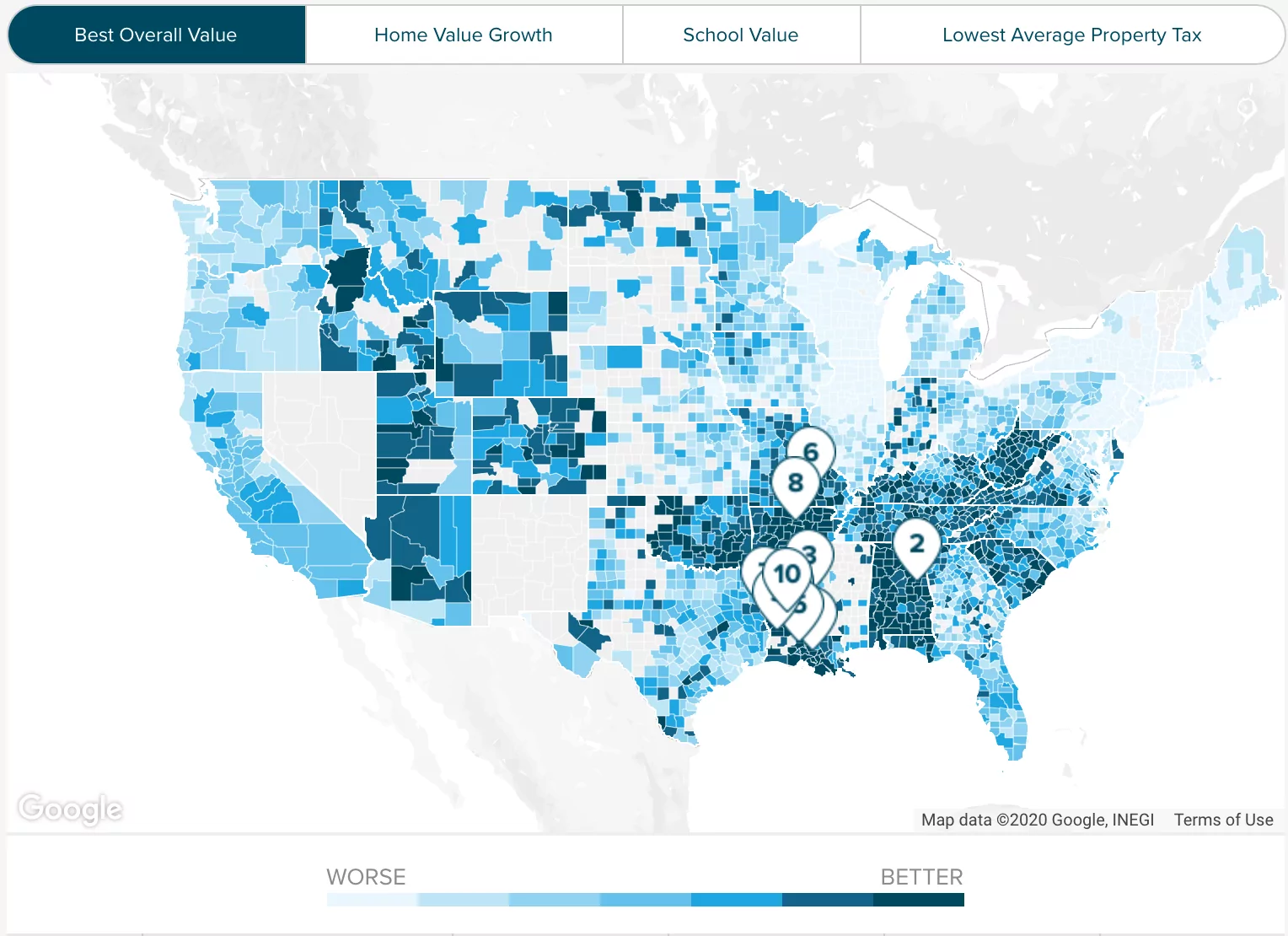

That rate ranks slightly below the national average. The exact property tax levied depends on the county in Kentucky the property is located in.

Kentucky Property Taxes By County 2022

For comparison the median home value in Kentucky is.

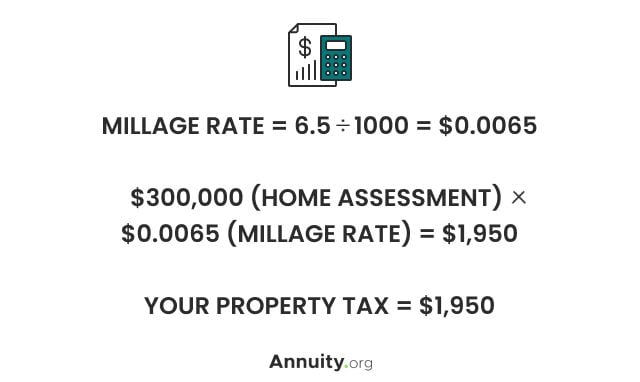

. Kentucky annual vehicle tax calculator. Maximum property tax levels also vary based on the size of the city and House Bill 44 1979. Various sections will be devoted to major topics such as.

Property taxes in Kentucky follow a one-year cycle beginning on Jan. The median property tax on a 14590000 house is 105048 in Kentucky. Maintaining list of all tangible personal property.

KRS132690 states that each parcel of taxable real property or interest therein subject to assessment by the property valuation administrator shall be assessed annually by the PVA at. Real estate in Kentucky is typically assessed through a mass appraisal. This calculator will determine your tax amount by selecting the tax district and amount.

For example the sale of a. This calculator will determine your tax amount by selecting the tax district and amount. Search Valuable Data On A Property.

Todays mortgage rates in Kentucky are 5354 for a 30-year fixed 4418 for a 15-year fixed and 4345 for a 5-year adjustable-rate mortgage ARM. At the same time cities and counties may impose their. The median property tax on a.

Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property. All property that is not. For this reason cities should be aware of what they can and cannot tax within their jurisdiction.

If you are receiving the homestead exemption your assessment will be reduced by. The Rowan County Sheriffs Department is now accepting Visa MasterCard American Express Discover credit cards for tax payments. A convenience fee of 249 for.

Maximum Possible Sales Tax. Start Your Homeowner Search Today. The median property tax on a 14520000 house is 104544 in Kentucky.

The median property tax on a 14590000 house is 131310 in Jefferson County. Different local officials are also. Actual amounts are subject to change based on tax rate changes.

Enter Your Address to Begin. Browse Current and Historical Documents Including County Property Assessments Taxes. Property not exempted has to be taxed equally and consistently at present-day.

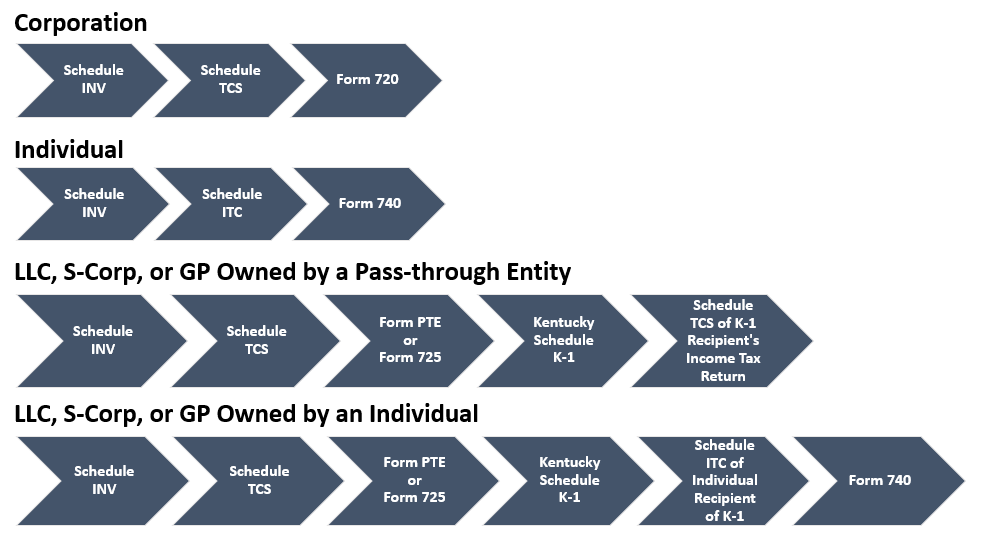

The assessment of property setting property tax rates and the billing and collection process. Therefore the DOR Inventory Tax Credit Calculator is the. Ad Research Is the First Step to Lowering Your Property Taxes.

Kentucky Property Tax Rules. Please note that this is an estimated amount. Ad Get In-Depth Property Tax Data In Minutes.

If the city had a rate of 20. Kentucky has a flat income tax of 5. Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan.

All rates are per 100. Average Local State Sales Tax. The Property Valuation Administrators office is responsible for.

If you do not receive a tax bill in the mail by the second week of November please contact our office at 502-574-5479 and. Every year tax bills are mailed in November. A citys real estate tax regulations should comply with Kentucky constitutional rules and regulations.

The Kentucky Department of Revenue is required by the Commonwealth Constitution Section 172 to assess property tax at its fair cash value estimated at the price it. For instance if a citys real property valuation increased from 10 million in 2019 to 105 million in 2020 a 5 increase the compensating rate would drop. Posted January 31 2022 January 31 2022.

Such As Deeds Liens Property Tax More. Oldham County collects the highest property tax in Kentucky levying an average of 224400. 1 of each year.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. Overview of Kentucky Taxes.

Jefferson County Ky Property Tax Calculator Smartasset

Property Tax Calculator Casaplorer

Property Tax Calculator Casaplorer

Property Taxes Calculating State Differences How To Pay

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Tax Calculator Mccracken County Pva Bill Dunn

Kentucky Property Tax Calculator Smartasset

How To File The Inventory Tax Credit Department Of Revenue

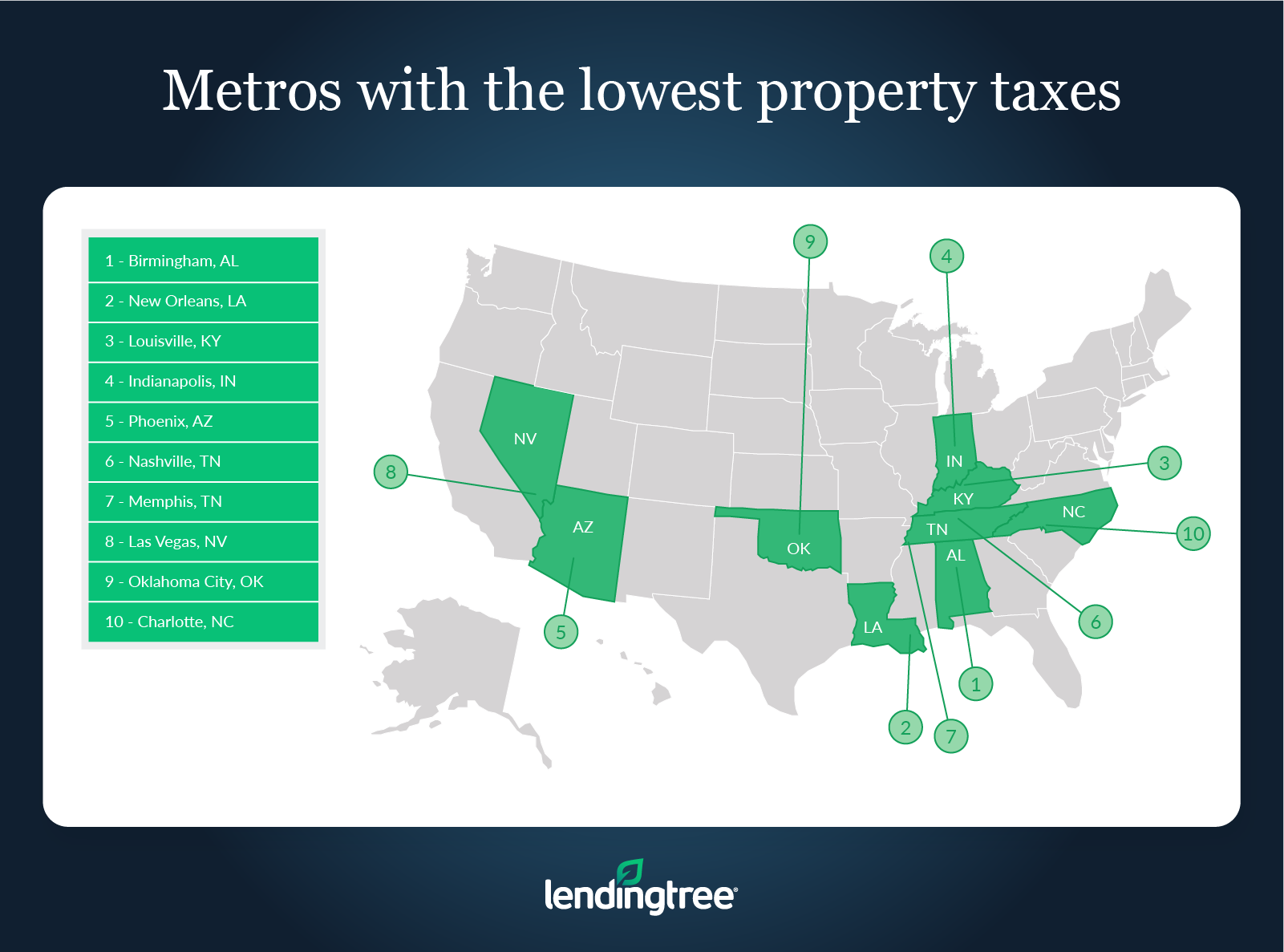

Where People Pay Lowest Highest Property Taxes Lendingtree

Jefferson County Ky Property Tax Calculator Smartasset

Warren County Ky Sheriff S Office Taxes

What Is Sales Tax Nexus Learn All About Nexus

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

North Central Illinois Economic Development Corporation Property Taxes